See This Report about Employee Retention Credit 2020

Wiki Article

Excitement About Employee Retention Credit 2020

Table of ContentsThe smart Trick of Employee Retention Credit 2020 That Nobody is Talking AboutThe Only Guide to Employee Retention Credit 2020The Employee Retention Credit 2020 PDFsThe Ultimate Guide To Employee Retention Credit 20205 Simple Techniques For Employee Retention Credit 2020The Of Employee Retention Credit 2020

Company F is a regional retail chain with procedures in various states. In some jurisdictions, Company F undergoes a governmental order to shut its stores, however is permitted to give consumers with curbside solution to get items got on the internet or by phone. In other territories, Company F is not subject to any kind of governmental order to close its stores, or is taken into consideration an important business allowing its stores to continue to be open.In this situation, "gross invoices" implies gross receipts of the taxed year and usually includes complete sales (net of returns and also allowances) and also all amounts got for services. Gross receipts might likewise consist of any type of revenue from investments, as well as from subordinate or outside sources such as passion, dividends, rental fees, nobilities and annuities no matter whether the money comes from regular company procedures.

For small employers, the meaning consists of earnings as well as settlements into a Qualified Health Plan per the suitable quarter. For big companies, it only includes salaries as well as repayments right into a Qualified Health And Wellness Strategy during the periods when employees might not carry out services due to Covid-19 limitations or a decrease in gross receipts - employee retention credit 2020.

Our Employee Retention Credit 2020 Diaries

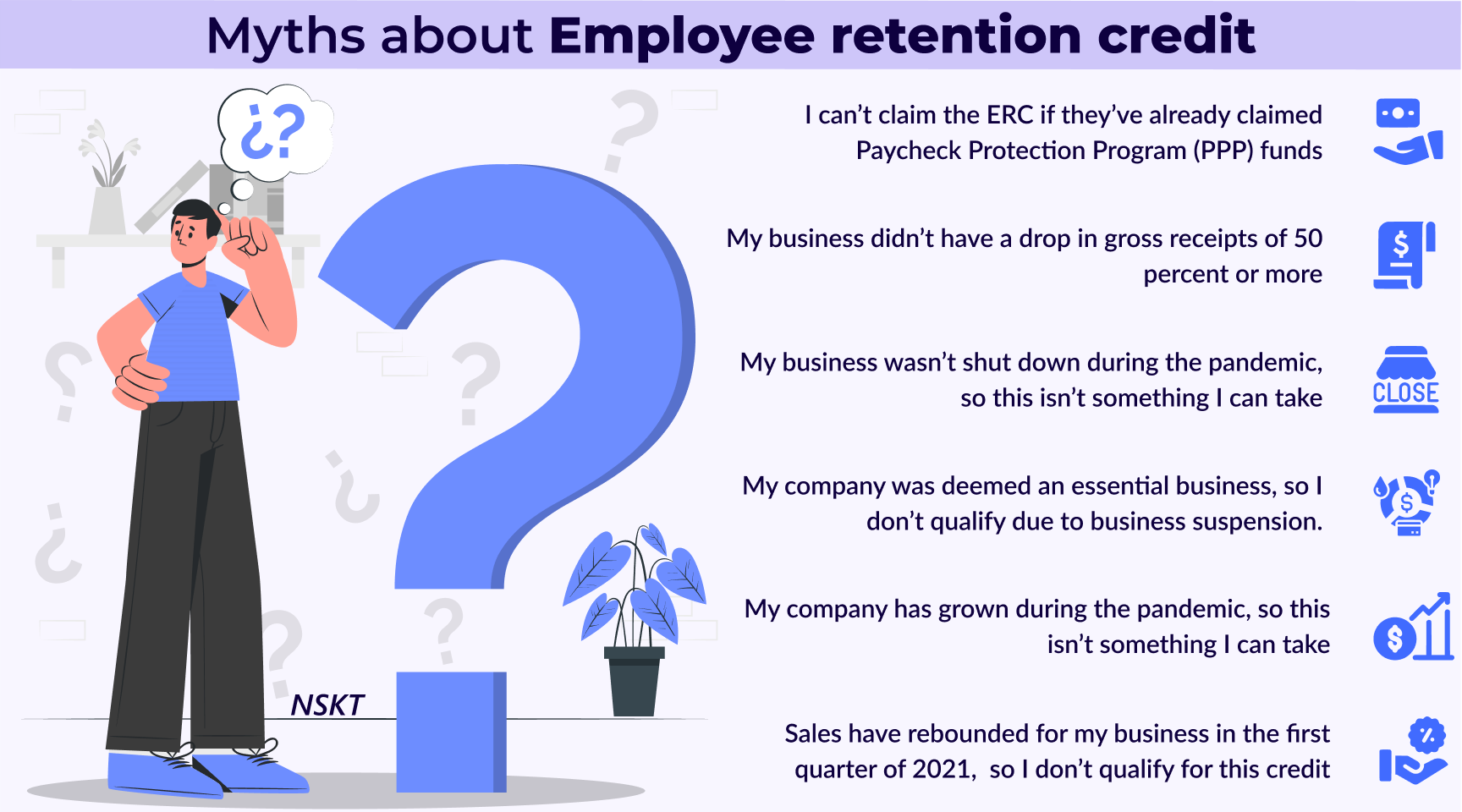

Even if the audit discovers that you owe money, your audit defense team will ensure you will not have to pay greater than you legitimately owe. That does not imply you require audit defense specifically for the ERC. It's definitely something to think about, provided the complex nature of the tax obligation credit score, as well as the adjustments that have actually been made to it over the past year.Should I look for the ERC if service is expanding? It depends on how much your organization is growing. As mentioned earlier, you're no much longer permitted to take the ERC in the quarter promptly complying with a quarter where your quarterly gross invoices surpass 80% contrasted to gross receipts in the very same calendar quarter the previous year.

All about Employee Retention Credit 2020

Companies need to seek advice from with proper legal as well as tax obligation consultants to identify whether the organization is qualified for the ERC, keeping in mind the various policies that get 2020 and 2021. On December 27, 2020, the (component of the Consolidated Appropriations Act of 2021) was signed into legislation, supplying further stimulation as well as support to those influenced by the COVID-19 pandemic.Employers ought to seek advice from ideal legal and also tax obligation advisors to figure out whether the company is qualified for the ERC, keeping in mind the various guidelines that obtain 2020 as well as 2021. There are several details and specific actions that are not completely explained over. IRS Form 941: Internal Revenue Service Form 941 Directions: https://www.

After browsing through the complicated regulations, numerous dining establishments have actually ruled out the opportunity of acquiring the credit history as a result of their initial understanding of the policies. We have actually found various methods for restaurants to certify for the ERC by taking a much deeper dive into the policies as shown listed below and also success tales we have actually seen in the dining establishment area: Unlike various other alleviation programs (i.

Employee Retention Credit 2020 - Truths

Within the dining establishment market, we are seeing an overstatement of the staff member count as a result of the inclusion of lots of part-time employees (employee retention credit 2020). Think about reviewing your full-time staff member count to see if you can get approved for the complete benefit of the credit score. A small franchisee of QSR dining establishments is estimated to safeguard over $500,000 in credit scores for 2020 alone after revisiting their full time worker matter, after at first believing they had over 100 workers.

A number of these restaurants initially believed they might not certify for the credit report, yet the need to either shut down or socially distance indoor eating spaces has actually still permitted some dining establishments to get approved for the credit report under the partial closure test. If your pre-pandemic dine-in profits were greater than a small component of your complete earnings, you might still receive the debt.

The Ultimate Guide To Employee Retention Credit 2020

If a restaurant does not meet the partial or full closure test, the dining establishment must have a 50% gross invoices Click Here decline relative to the same schedule quarter in 2019 to get the credit report in 2020 and a 20% gross my explanation invoices decrease family member to the same schedule quarter in 2019 to qualify for the debt in 2021.e. cash basis when amassing is utilized for financial declaration purposes). Additionally, gross invoices include items not generally considered gross invoices for financial declaration functions (i. e. passion revenue or gain on the sale of certain properties). Ensure you are calculating the gross receipts decrease on the proper approach of accountancy which you are consisting of all items in gross invoices as suggested by the tax regulation.

[This post has been updated from an earlier variation.] The Infrastructure Financial Investment and Jobs Act authorized by the House on Nov. 5, 2021, accelerated completion of the credit score retroactive to Oct. 1, 2021, as opposed to on Jan - employee retention credit 2020. 1, 2022 (besides salaries paid by a recovery startup organization, for which the expiry day would continue to be unmodified).

The Main Principles Of Employee Retention Credit 2020

"Although the program is set to sunset at the end of 2021, the credit rating can be declared on changed payroll income tax return as long as the statute of limitations continues to be open, which is 3 years from the day of declaring," claimed Brent Johnson, founder as well as CEO of Clarus R+D, a maker of software application for declaring tax obligation credits.

Those changes consist of, amongst other things: Making the credit rating readily available to eligible employers that pay qualified wages after June 30, 2021, and prior to Jan. 1, 2022. Providing that the staff member retention credit score does not apply to qualified incomes taken into account as payroll costs in link with a shuttered venue grant under area 324 of the Economic Help to Hard-Hit Small Businesses, Non-Profits, as well as Venues Act, or a dining establishment revitalization give under section 5003 of the ARPA.Notice 2021-49 additionally reacts to various concerns that the Treasury Division and also the IRS have actually been asked regarding the worker retention credit rating for both 2020 as well as 2021, consisting of: The interpretation of permanent employee and also whether that definition includes full time equivalents.

Report this wiki page